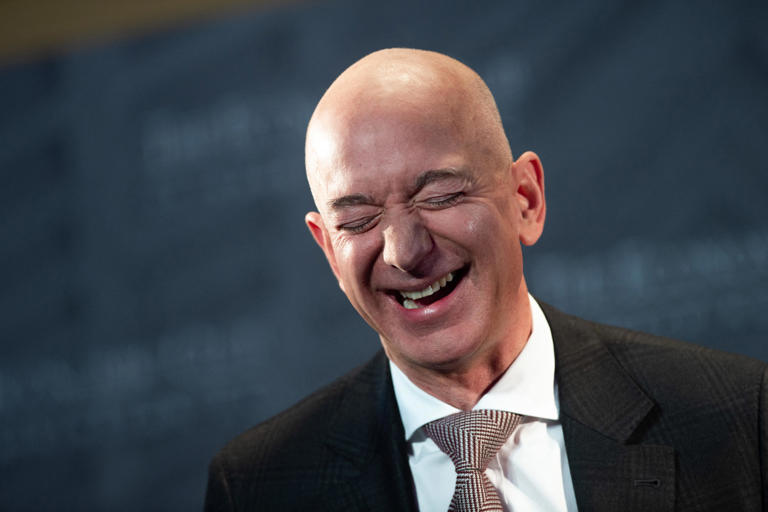

- Jeff Bezos just reclaimed his title as the world’s richest person.

- Bezos’ wealth surge is due to a rally in Big Tech shares, incuding Amazon.

- Tesla CEO Elon Musk now ranks second on the Bloomberg Billionaires Index.

It’s been more than two years since Amazon founder Jeff Bezos was the world’s richest person, but he’s now back in the lead again.

As of Tuesday, Jeff Bezos has reclaimed the title of the world’s wealthiest individual, boasting a staggering net worth of $200 billion, as per the Bloomberg Billionaires Index.

This resurgence in Bezos’ wealth comes on the heels of a sustained surge in Big Tech stocks, fueled by the flourishing artificial intelligence sector. It marks his return to the pinnacle of wealth, a position he last held in 2021.

Amazon, the e-commerce behemoth of which Bezos owns approximately 9%, has seen its shares surge by 17% year-to-date and a remarkable 90% over the past year. Despite a marginal 0.4% dip to $177.58 per share on Monday, Amazon’s upward trajectory significantly contributes to Bezos’ soaring net worth. Moreover, Bezos’ ownership of Blue Origin, a space exploration company, further bolsters his financial standing, factored into Bloomberg’s calculations.

This development sees Bezos oust Tesla CEO Elon Musk from the top spot, a position Musk held for nine consecutive months. At one juncture, Musk enjoyed a staggering $142 billion lead over Bezos, as per Bloomberg data.

Bezos initially surpassed Microsoft co-founder Bill Gates to claim the title of the world’s richest person in 2017. However, he was dethroned by Musk in 2021 amid a remarkable surge in Tesla’s stock value.

Presently, Elon Musk and Bernard Arnault, the chairman of LVMH Moet Hennessy Louis Vuitton, occupy the second and third positions on the Bloomberg Billionaires Index, with net worths of $198 billion and $197 billion, respectively.

In contrast, Tesla’s stock has endured a rocky start to the year, plummeting by 24% year-to-date and experiencing a 3% decline compared to the previous year. The EV manufacturer faced a setback on Monday when its shares tumbled by 7% following a slump in China sales during February.